“Money doesn’t buy happiness” they say. Well, they lied. Money absolutely buys happiness – the problem is – it only buys so much. So as you start planning for the future, you need to make sure you have enough money to purchase the optimal amount of happiness.

Now to give you a background about myself. I’m currently in my younger 30s and planning to have enough assets to make “work optional” in the next 7 years. As of the time I’m writing this, I’ve made 1 penny from ads – so let’s just say I’m not some rich blogger.

Ben Franklin: “A penny saved is a penny earned you know!”

Me: Yep, and a penny earned is still pretty useless just like that advice, but thanks Ben“

Here is the the great thing. Even though my profession is in personal finance – I guarantee that you do not need a degree to build wealth that will last in perpetuity. You do not need to “get lucky ” (unless you consider finding this blog lucky). You do not even need to make a ton of money! However, you MUST make enough. The reason for this is because of marginal utility.

Steve: “Oh look he put something in bold! Maybe I should pay attention”

Me: “I know your going to forget that term in like 5 minutes either way Steve”

To explain marginal utility let’s look at an example using Steve, Bob, and Rich. Steve works in fast food making 10 bucks an hour – because there are 2080 working hours in an American work year he makes 20,800 bucks.

Bob on the other hand has a small lawn care business. He gets paid 50 dollars every time he mows an average size yard. When factoring in travel time and miscellaneous each yard takes about 1 hour of work. Lastly the cost to operate his business is 10 dollars per lawn mowed. This pays for his gas, truck, etc. If Bob works the same amount of hours as Steve his total gross income would be 40*2080= 83,200. Bob still has to pay for medical insurance, but you can quickly see that Bob makes more income.

Lastly, we have Rich aka Richie Rich. He is the CEO of some super lame sounding company that does credit card processing. Richie makes 3 million a year. No math needed – he is loaded.

Now what if all the sudden each received an unexpected 15,000 from a scratch off ticket they found. Well Richie would barely even notice. He already buys all the stuff he wants – he would be “forced” to just take that 15K and invest it in something else. Thus, making Richie even more money – even though he doesn’t want or need it! Bob already is able to pay his bills too, but he’d likely use that money to grow his business or save for his future. He feels pretty glad for the boost, but he was doing alright.

But Steve… poor Steve. He is barely scraping by making ends meet. This money would allow him to pay his rent on time and fix up his car that’s been making that weird noise. You know, the noise that when he turns the radio down he thinks to himself “the noise isn’t as bad as he thoug— oh wait he just heard it again.. and yeah that can’t be good.” Oh well, Steve can just put the radio back on and it’s like there isn’t any problem!

When he gets that 15K it’s life changing. He is so happy he can barely contain himself. This is marginal utility. You see most things in life you need a little bit of that thing, but once you have enough getting more doesn’t make much of a difference.

Janet: “I am so excited I am getting my 45th cat this weekend! Want to come over??“

Me: “No. not at all Janet.“

So you only need 2500 calories in a day, 8 hours of sleep, but how much money? How much money does Steve have to make before he feels happy? Well let me introduce you to Exponential Decay of Return.

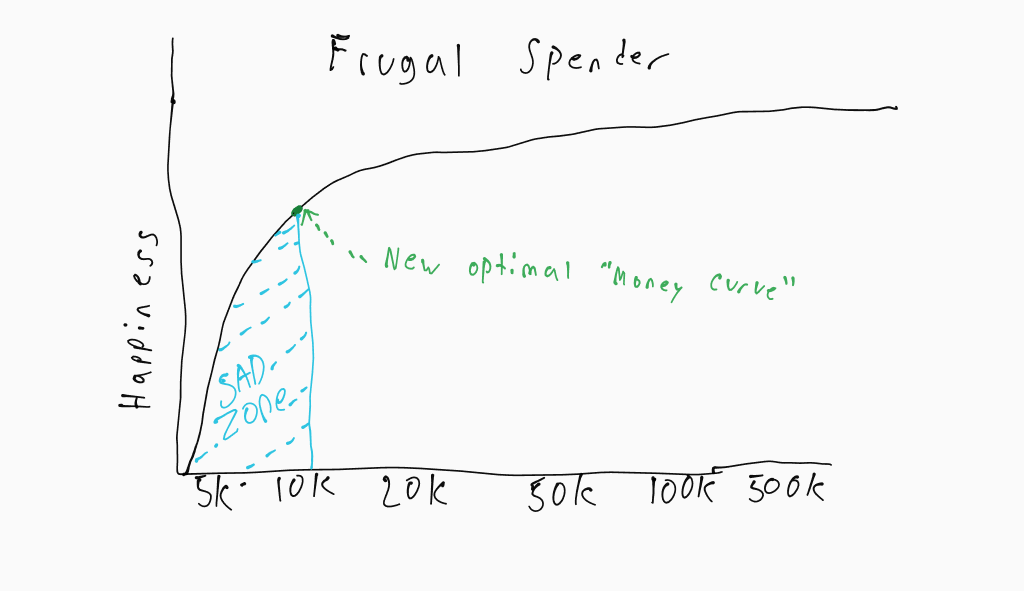

As you can see there is a limit to how much happiness you can possibly get from money. I call this your Happy Ceiling. Unfortunately for you folks reading this already making tons of money, you’re actually going to have to maintain a healthy lifestyle, get enough sleep, and even worse have great relationships with the people around you to get any happier.

Richie: “Can’t I just make more money?“

Now there was a study done in 2010 that showed you need to make about $75,000 (net) to hit that “sweet spot” in my exponential decaying curve. That isn’t quite scientific enough for me though, because people live in cities with different costs of living. So let’s try and help you build your own curve.

Let’s use what drives your expenses: Housing, Food, and Automobile Expenses.

Those three items should make up 50 to 75 percent of the spending that’s essential to live. But there is one other wrinkle to look at; what kind spender are you? This factors a lot in building your curve as well. There is a range of “expected lifestyle” you have and it looks like this:

Frugal > Thrifty > Average Joe > Keeping up with the Joneses > Keeping up with the Kardashians

We are going to use housing cost to help figure out your lifestyle. If you are a renter simply take your rent and add utilities. If you own your home (or have a mortgage) take the value of your home (you can use https://www.zillow.com/ to calculate this) and divide by 120 and then add your utilities.

So let’s look at where I live in Central Florida. The frugal or thrifty spender will be under 1000. The average spender is going to spend around 1,000 to 2,000 depending on bedrooms needs. The Jones’s are going to be spending between 2,000 and 4,000. And finally the Kardashian’s are 4,000+.

Regardless of where you live – you can shortcut your way to Food and Automobile expenses ( which includes ALL eating out, alcohol, insurance on your car, etc). Simply take your housing numbers and divide by 2 for food and then do the same for automobiles but divide by 3. (If you know your budget obviously you can use that number).

So the average Joe here spends $1500 on housing, $1000 on food (using 1.5 as divisor), and $750 (using 2 as divisor) for total auto expenses. Larger families should use the lower divisor.

This means the Average Joe needs 1500+1000+750 = $3,250. Now the most “fun/unexpected/everything else” you should have is double this number which bring us to $6,500 for your optimal happiness spending. Now, I literally came up with these numbers prior to doing this last bit of math which shows 6500×12 months = $78,000. (Right where the 2010 study suggested!)

This means my household needs to make $78,000 to be optimally happy! This also means every dollar my household spends more than that is mostly just wasted and probably frivolous. After making 78,000 (after-tax) I should start seriously saving my money. In my opinion you should not live any higher than an “average joe” until your income is DOUBLE your optimal happiness number. You need to save 50% of your income if you want to benefit from the exponential growth of genetics, AI, and technology in general.

So let’s go back to poor ole Steve. If you are reading this and you are closer to a Steve – you need to live Frugal or Thrifty AT AT MOST. It’s absolutely possible to get above “The Money Curve” by designing a life you love that requires less.

It does take work to be happier with less. Think about a company becoming more and more efficient. Maybe you get a fixer-upper Triplex to live in. In addition you do the fixing up work yourself and rent out the other two rooms. For food perhaps you create a meal plan that optimally uses a weeks worth of food so there is no waste (i.e you buy 5lb bag of potatoes that you’ve mapped our recipes to perfectly use it during the week). Lastly, you can drive a car that cost less than 4K that is fuel efficient. This will also lower your car insurance because you don’t need collision, and you’ll spend less on washing it, etc. So a frugal spender would be: 500 housing, 250 food, 167 car.

You also should be actively thinking about every way possible to increase your income. You should still follow the rule – never “go up” in lifestyle until you have achieved a 50% savings rate.

You see that’s the key – everyone wants to live like an Average Joe level of happiness, but few make enough money to live it. You need to make double the amount of money of the spending level you are optimally happy. This allows you happiness now, happiness later, and potential exponential happiness later with compounding interest.

End Part 1.